Summary

Investment in strengthening public institutions has been identified as necessary for effective policy implementation and public service delivery. Lately, key intergovernmental institutions including the OECD, UN and World Bank have identified tax administration (SDG17-Target-17.1) as one particular public institution that must be strengthened to mobilize the additional revenue required for implementing the Sustainable Development Goals (SDGs), in an efficient, accountable manner (SDG16-Target-16.6). There is increasing anecdotal evidence that some of the digital technologies can significantly support the transformations required in public institutions to tackle societal challenges like those associated with the SDGs. However, systematic studies on how digital technologies have been harnessed to address specific societal challenges or employed in specific public institutions to achieve significant changes remain sparse. Recently, tax administrations in OECD countries, led by the Irish Revenue, highlighted their experiences on the adoption of advanced data analytics technologies across different functions in their respective institutions. This project aims to carry out a rigorous study of how the contextual, organisational, technological and human factors interact in the adoption of data analytics and digital technologies in tax administrations. Through in-depth interdisciplinary case studies of selected tax authorities that have adopted and used data analytics and other digital technologies, we will: 1) develop a refined understanding and model of successful digital technology adoption in public institutions, 2) translate findings into guidelines for decision-makers on how to effectively deploy digital technologies, in a transparent

and accountable manner; and 3) Identify necessary technical updates to standards related to the deployment of the respective digital technologies in public institutions. Our findings are expected to impact the capacity of tax administrations to effectively support the implementation of SDGs.

Research Questions:

Specifically, the proposed project aims to answer the following four research questions:

R1. What are the major constructs that determine the effective (or beneficial) use of digital technologies in tax administrations and how are the constructs related?

R2. How do endogenous and “beneficial use” factors lead to benefits such as greater effectiveness, accountability and transparency in tax authorities, and ultimately achieve the desired development impacts with respect to SGD17?

R3. How is the adoption of these digital technologies impacting traditional governance, risk management and other high-level organisational processes within tax administrations?

R4. How can digital technologies be better deployed and managed in tax institutions taking into consideration issues like EU General Data Protection Regulation, traceability of data and related industry standards like CRISP-DM in the case of data analytics?

Methodology:

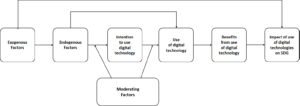

In this study we are adopting the Case Study research method, enabling us to explore the case(s) from multiple perspectives, using different tools including quantitative and qualitative methods (Eisenhardt 1989). We will analyse three cases involving the use of a complementary set of digital technologies including data analytics in tax administrations. We assume the theoretical model in the figure below as a starting point in our enquiry allowing for a deductive approach while being open to discovery of new constructs or refinement of existing ones (inductive). This model will be drawn upon in this study of the factors for successful adoption of digital technologies in public institutions for greater effectiveness and ultimately, developmental impact.

Impact:

This project will significantly advance knowledge and demonstrate how Data Analytics and other future technologies can be developed and employed in public services efficiently and effectively, to manage societal challenges and opportunities, focussing on a study of arguably the most important area of public administration i.e. tax administration. It is expected that knowledge collected and lessons learned from this project in relation to the adoption of technologies in a public administration context will be transferable to other areas of public administration. It will therefore, seek to demonstrate the transformative capacity of Data Analytics and other technologies to

help deliver excellent public service delivery. This project will demonstrate the role of advanced technologies, Data Analytics in the first instance, in delivering a fair and efficient tax system, which promotes inclusive and sustainable growth, is fundamental to delivering SDGs, and necessitates fighting tax evasion, money laundering and illicit financial flows. Critically, this project will assess the potential for disruptive technologies to enhance public accountability and enhance citizens’ trust in government – a critical tax administration success factor as well as addressing SDG 16. Dissemination activities will target the scientific community, practitioner and policy as well as standardisation bodies related to digital technologies under study.

Funded by

For more information

For more information, please contact Professor Emer Mulligan at emer.mulligan@nuigalway.ie.